Understanding Bankruptcy and Insolvency Act

Posted On : March 25, 2022

Table of Contents

Have you heard about Abhimanyu of Mahabharata? He knew how to enter the Chakravyuh and how to compete as well. What he was not aware of was how to exit the Chakravyuh, and that is where his defeat was affirmed. The same used to happen with the corporate sector in the past few years. Provisions for entry in the corporate sector were eased through introduction of LPG (Liberalisation-Privatisation-Globalisation). Even competition in the market was paved way for via eradication of monopoly assured through the Competition Act, 2002. But, the winding up of a company was a very tiresome and never ending process which proved a chronic disease for the Indian economy over time. When so many laws proved inefficient, the Insolvency and bankruptcy (IBC) Code 2016 arrived as a blessing. Hereunder, various facets of how IBC 2016 uplifted the Indian market for business have been dealt with.

Background of Insolvency and Bankruptcy Code

When there comes a new rule, its need is realized in advance, as we say ‘Necessity is the mother of invention’. There were tranquil ways for companies to incorporate and compete in the business world. It was realized later that there has to be some room for companies to exit the business world without leaving big potholes for the creditors.

Before the Bankruptcy and Insolvency Act, there were laws like SICA (Sick Industrial Companies Act) and Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI) which did not perform up to the mark which they were introduced for. In 2015, Asset Quality Review was done by the Reserve Bank of India which disclosed high NPA rates in India. Since the pre-existing laws were insufficient for resolving the problem of creditors, banks and the companies, the Bankruptcy and Insolvency Act India came into force in 2016. The IBC 2016 is termed a Code because it is an amalgamation of various pre-existing Acts dealing with the issues around Bankruptcy and Insolvency Act. These laws also include SARFAESI Act, 2002 and the Sick Industrial companies (Special Provisions) Act, 1985. Look out for banking lawyers near me for local assistance in your area.

Purpose of Bankruptcy and Insolvency Act

The Insolvency and Bankruptcy Code was introduced in 2016. The aim behind IBC 2016 was to resolve claims of creditors of insolvent companies, non-corporate entities like LLPs/firms and individuals, and also the pressure over the banking sector due to Non-Performing Assets (NPAs). The track record of Bankruptcy and Insolvency Act 2016 affirms the backdrop idea while introducing the Code through wide success of resolving defaulting corporations. The IBC Code 2016 empowers financial creditors with an increase in recovery rate. As per World Bank 2020 report on Ease of Doing Business which assesses business-friendly regulations, India ranked 63 improving 79 pointers since 2014 which is a great achievement. Another golden feather is the out of court resolution of insolvency after the advent of IBC 2016. Earlier without Insolvency and Bankruptcy Code, the corporate insolvency matters used to burden courts as well as the people affected by it. Now, debtors are paying money to banks even before declaration of insolvency in anticipation of default or not to cross the red line and come in the radar of the National Company Law Tribunal. The two way sword that prioritizes resolution followed by liquidation has effectively helped resolving insolvency cases.

Framework of Bankruptcy and Insolvency Act, 2016

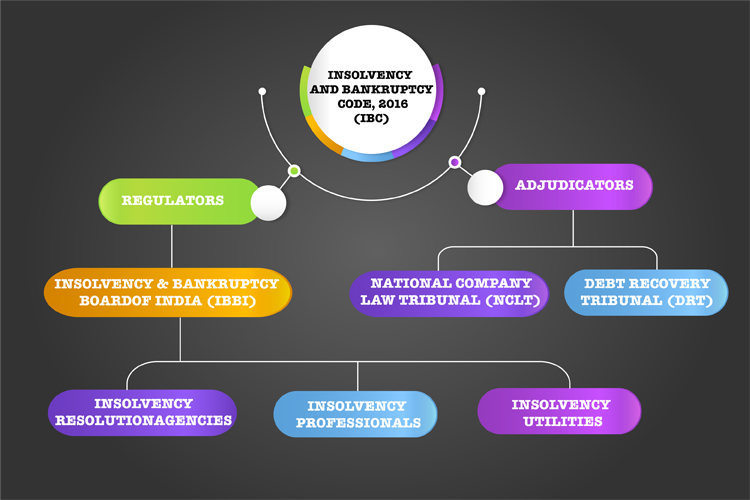

IBC 2016 brought along a team of professionals who were handed over the responsibility of regulation and adjudication of matters. With the help of flowchart provided below, it may be noted that the Bankruptcy and Insolvency Act India appoints two bodies, Regulators and Adjudicators. The Insolvency and Bankruptcy Board of India is the top notch regulatory body. It consists of Insolvency Resolution Agencies, Insolvency Professionals and Insolvency Utilities. On the other side, the adjudicating bodies include National Company Law Tribunal (NCLT) and Debt Recovery Tribunal (DRT). It must be noted that DRT has been associated with insolvency since its establishment in the 1990s. However, NCLT has been handed over the tasks through IBC Code 2016 only.

Understanding the Roles

- Insolvency Resolution Agencies - They are responsible for framing the codes and ethics to be followed in order to effectively accomplish dept paybacks.

- Insolvency Professionals - These are professionals who handle the management of a company declared insolvent.

- Insolvency Utilities - These are financial advisors for debt recast/ restructure/ reconstruction plan.

- National Company Law Tribunal - Responsible for adjudicating insolvency matters involving corporate entities.

- Debt Recovery Tribunal - Responsible for adjudicating insolvency matters related to non-corporate entities like LLPs, firms and individuals.

Process for Insolvency and Bankruptcy

The Bankruptcy and Insolvency Act 2016 lays a four-step process for resolving the debts or liquidating the company assets based on what suits best as per facts:

- The creditors or debtors approach NCLT/DRT to initiate insolvency process.The application has to be accepted by NCLT or DRT, as the case may be, within 14 days.

- The lenders/ creditors shall join hands for the formation of ‘Committee of Creditors’ to thereby appoint ‘Insolvency Professional.’ The Insolvency Professional(s) hereby appointed shall run the company during this interim period while the insolvency matter continues. IP has 180 days or in some complex issues, additional 90 days to deal with the matter.

- After expiry of the given period, the CoC gives a ‘Debt Recast Plan’ to help creditors reach the final resolution.

- Either the Debt Recast Plan is adopted if all the creditors agree for resolution of insolvency. Otherwise, the company proceeds for liquidation during the final resolution. All the company assets are liquidated and distributed among the creditors in accordance with their shares.

Advantages of IBC Code 2016

It has been a few years since IBC Code 2016 came into existence. But the effectiveness of the same is assured through the following pointers:

- A panoramic law

- Ease of doing business - World Bank Ease of Doing Business Rank 63

- Good for Banks and Asset Reconstruction Companies (ARCs)

- Time bound process - 180 days or additional 90 days

- One stop solution for bankruptcy matters

- A solution for NPAs and ‘haircut’

- Relieving locked up assets

- Ease of investment in India

- IBBI is the authoritative body which consists of professionals

- Improvement in Corporate Bond Market

Inference

Where there is a will, there is a way. And where there is a good law and its implementation, there are great results as well. A well drafted law may lose its essence due to a few loopholes in it. Since a company is not a real identity but some real persons, i.e. humans act with the company’s face, it is quite often for those people to mess things up which diminishes the company’s ability to remain in business. Wrapping up such business has been eased through the Insolvency and Bankruptcy Code. However, the problem of NPAs is not yet fully resolved which needs in-depth research and treatment.

[1] Liberalization, Privatization and Globalization Scheme of 1991. [2] Limited Liability Partnerships.