Cheque Bounce Lawyers

Cheque Bounce Lawyers in India

Commercial transactions on a day today basis is normal for people engaged in business. The modes of such financial transactions may be in cash, NEFT or through cheques as well. Sometimes, transactions through cheques bring about certain ups and downs since the other person’s bank balance is not mentioned on the cheque so accepted. And whenever a cheque is dishonoured by the bank then the payee has the right to file a case of cheque bounce under the Section 138 of Negotiable Instrument Act, 1881. In such cases, lawyer for cheque bounce case is needed for matters in any or specifically in Cheque Bounce CMM court (Chief Metropolitan Magistrate). Find out the list of cheque bounce lawyers in your location and the laws invoked.

Questions Around Cheque Bounce in India

What is cheque bounce?

What are the ways or reasons that a cheque can bounce for?

What happens when there is cheque bounce?

Who is liable to pay in case of Cheque bounce?

What is legal recourse for cheque bounce for the payee and for the payer?

What is the maximum penalty and punishment for cheque bounce?

Can out of court settlement happen in case of cheque bounce case?

Will cheque bounce case still hold good when the issuer has gone bankrupt?

Can I pay the amount while the case is going on, and get the case closed?

Will marking a cheque STOP amount to cheque bounce?

Can I get arrested for cheque bounce?

Is bail a necessity in cheque bounce cases?

Cheque Bounce Case in India

Cheque bounce lawyers deal with matters whereby bounced cheque or a dishonoured cheque is a situation wherein the payer’s bank abstains from making the payment to the payee for different reasons like mismatch in the signature/account number, insufficient funds in drawer’s account, etc. Cheque bounce stalls the normal transactions in the commercial world and thus, hinders the growth in business. Since it affects the business cycle in a big way, the lawmakers have made the cheque bounce a criminal offence and a punishable act.

Vidhikarya will help you with the most suitable cheque bounce lawyers in your city. Lawyer for cheque bounce case will be able to answer all your queries, whether you are the issuer of the cheque or payee, and also guide you on how to resolve this matter with ease.

Once a cheque bounce has happened and the payee has initiated a case, then the defaulter has no option but to either pay the amount within the stipulated time, or else defend the case in the court with the help of cheque bounce lawyers.

So, what Vidhikarya can do for you is that it will help you in engaging a right and suitable lawyer for cheque bounce case so that you can be saved of all the hassles around this case.

We at Vidhikarya endeavour to help you and assist with the right cheque bounce lawyers in your city or otherwise so that you can go ahead and peacefully get your legal matter resolved. You do not have to worry on how to hire a cheque bounce case advocates near me for the matter.

For matters of cheque bounce in Kolkata, consult with the Cheque Bounce Lawyer in Kolkata. Also find cheque bounce lawyer for Bankshall court.

What is Cheque Bounce law and What it Does?

Section 138 of the Negotiable Instruments Act 1881

Section 138 of the N.I. Act makes dishonour of cheque for insufficiency of funds a statutory offence. As per this provision, bouncing of any cheque issued for a legally enforceable debt or liability can be a ground for a lawsuit with certain conditions.

Conditions for applicability of Section 138 of N.I. Act

Cheque must be drawn within a period of three months from the date it’s drawn or within the period of its validity, depending on whichever date is earlier.

The holder (one who was supposed to get the money after depositing the cheque) has to demand for the payment of the bounced cheque within 30 days from the day when he was made aware about the return of the concerned cheque as unpaid.

The drawer of the cheque must have failed to make payment of the concerned amount to the payee within 15 days from the date of receiving the ‘Notice’ spoken of in the above point.

The debt must be a legally enforceable debt, the burden of proof of proving the illegality of the debt lies on the drawer of the cheque.

Other Laws Applicable to Cheque Bounce in India?

Indian Penal Code, 1860

Section 420 of the Indian Penal Code may be attracted:

Supreme Court in the case of ‘Sangeetaben Mahendrabhai Patel v. State of Gujrat’ has held that simultaneous proceedings under Section 138 of the N.I. Act and Section 420 of the Indian Penal Code(IPC) for a case of cheque bounce is permissible.

However, the dishonest or malafide intention has to be shown by the prosecution to invoke a case under Section 420 of the IPC for an instance of cheque bounce, and this provision does not deal with recovery of money.

Some important facts and cases about and under Cheque Bounce law

There are some things which the cheque bounce lawyers in India follow while dealing a matter:

- The Offence under the Cheque Bounce is compoundable

The offence punishable under Section 138 of the Act of 1881 is primarily related to a civil wrong and the Amendment [The Negotiable Instruments (Amendment and Miscellaneous Provisions) Act, 2002] of 2002 specifically made it compoundable.

The Hon’ble Supreme Court in Damodar S. Prabhu v. Sayed Babalal H., (2010) 5 SCC 663, held that the Accused could make an Application for compounding at the first or second hearing in which case the Court ought to allow the same. If such Application is made later, the Accused is required to pay higher amount towards cost etc. It was also held compounding could not be permitted merely by unilateral payment, without the consent of both the parties.

- No need of “mens rea” or guilty mind to be proved

In Mayuri Pulse Mills v. Union of India, Court held that for an offence under Section 138 of N.I. Act, mens rea is not essential as the section brings into operation the rule of strict liability.

- Jurisdiction for filing a cheque bounce case

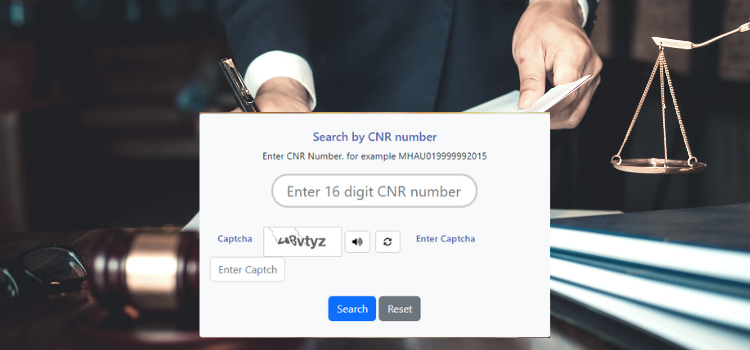

In Dashrath Rupsingh Rathod v. State of Maharashtra it was held that a complaint regarding “dishonour of a cheque” can be filed only in the Court within whose local jurisdiction the offence was committed, i.e., where cheque was dishonoured.

- Technical Reasons can not be grounds for Cheque Bounce case

Reason for the bouncing of cheque should not be of a technical nature, as technical irregularities are not covered by the provisions of Section 138 of the N.I. Act. For example, bouncing of a cheque due to incorrect date entered, or due to discrepancy between amount in words and figures, not being in MICR form, etc.

Important Procedures under Cheque Bounce Law

- Cheque must be presented to the bank for payment within a period of three months (earlier it was 6 months) from the date mentioned on the cheque.

- In case the cheque gets bounced, the holder of the cheque should ask the payer or issuer for the payment by giving a legal notice to the drawer in writing within 30 days of the receipt of information of non-payment by the bank.

- Even after receipt of notice, if the drawer of the cheque fails to make the payment within the stipulated time, which is 15 days from the receipt of notice, then the cheque holder or the payee can move the court.

Outcome of Cheque Bounce Cases

- Fine and Punishment under Section 138 of the N.I. Act

Punishment for the above-mentioned offence is a fine which may extend to twice the amount of the original cheque or imprisonment for a term which may be up to two years or both.

- Interim Compensation can be ordered

Court can pass an order to pay interim compensation during the pendency of the court. (This law is getting enacted)

Cheque Bounce Lawyers FAQs

Q- How much do cheque bounce case advocates near me charge?

A- The cheque bounce lawyers fees may vary depending upon the experience and success rate of such lawyers. During consultation with the lawyer for cheque bounce case, it should be discussed whether litigation charges will be incurred in the suit or the client has to pay, and in that case, the amount payable too.

Q- How can the check bounce case be overcome?

A- The cheque bounce lawyers in India can better answer this option based on the facts of each case. The person against whom the transaction bounced, he may get the payment or the other party may have to face imprisonment as well in case of inability to pay.

Q- Can I get anticipatory bail in 138?

A- Anticipatory bail is granted for serious, non-bailable offences. However, Section 138 is bailable with imprisonment of 2 years. Thus, the cheque bounce lawyers will not suggest anticipatory bail to their clients. Other options for bail in cheque bounce case are open.

Q- What is the punishment for cheque bounce in India?

A- The punishment for cheque bounce U/S 138 of the Negotiable Instruments Act of 1881, can be imprisonment for a term of 2 years and/or a fine and it might be as double the amount of the cheque.

Q- What is the new rule of cheque bounce case ?

A- If a person is convicted of a second or subsequent cheque bounce, they may face up to two years in jail and a fine of up to double the value of the cheque.

Q- How long does cheque bounce case take in India?

A- If the lawsuit proceeds to court, the verdict might take anywhere from 2 to 5 years to become effective. In India, the legal recourse for cheque bounce instances is clear [under the Negotiable Instruments Act]

Q- Is Cheque Bounce a criminal case in India ?

A- Yes under the Negotiable Instruments Act, 1881. It can be civil as well if the payee does not drag the drawer into punishment and goes for recovery of the money.

Search Result : Expert Cheque Bounce Lawyers

Consult Expert Cheque bounce Lawyers in India

Advocate Abhimanyu Shandilya

Advocate Anik

Bangalore

Advocate Arvind Tripathi

Allahabad

Advocate Shrikrushna Tambde

Nagpur

Advocate Bharat Majmundar

Vadodara

Advocate Girraj Prasad

Jaipur

Advocate Karunasish Chakraborty

Kolkata

Advocate Abhradip Jha

Kolkata

Advocate Jaswant Singh Katariya

Gurgaon