Overtime Payment Rules In India

Posted On : May 31, 2022

Table of Contents

Did COVID-19 make you work overtime to save that job? Were you paid a single penny for those overtime hours in addition to the regular wages? The answer might be negative and this fact reflects the want of overtime laws for salaried employees. There are several workplaces which are subjects of labour law on overtime in India. Whether the central or state government is empowered to decide the applicable overtime payment rules is provided in such legislations. One should take note of the fact related to state laws that the overtime rules in Gujarat may not be identical to the overtime payment rules in Maharashtra or any other state. Know more about labour law on overtime in India.

Overtime Payment Rules in India

There are several laws in India which govern the maximum overtime hours allowed in India and also provide for an overtime calculation formula in India. Currently, the overtime laws for salaried employees are not functional for many industries. However, in the coming days with the enforcement of new labour codes in India, the picture may change for betterment. Consultation with local labour lawyers may help employees/ workmen understand who is eligible for overtime pay in India.

What are the Rules for Extra Wages for Overtime?

Based on the industry one works for, the overtime payment rules vary. Some workplace may be governed by the central laws while the other might be a subject of state laws. Knowing employee rights may empower the working class. Given below are the overtime payment rules under several legislations:

Factory: Factories Act, 1948

- Weekly Limit - Maximum 48 hours a day.[1]

- Daily limit - Maximum 9 hours a day.[2]

- Interval - No work for more than 5 hours without an interval.[3]

- Spreadover - Working hours including interval period not more than 10.5 hours.[4]

- Overtime limit - Daily work time inclusive of overtime shall not exceed 10 hours which is 60 hours on a weekly basis. Overtime hours can not exceed 50 hours in a quarter (3 month period).

As per the Section 59 of Factories Act, 1948, a person is entitled to be paid overtime wages twice his ordinary rate of wages in case he/ she is required to work for more than 9 hours a day or more than 48 hours in a week. The wages mentioned here is equivalent to the basic wages along with allowances, but does not include any bonus or other overtime wages. In case a worker is paid on a ‘piece rate’ basis, time rate will be calculated on the basis of previous month and the amount of overtime wages will be calculated accordingly.

Shop/ Establishment: Shops and Establishments Act of States/ UTs

- Daily working hours may range from 8-10 hours

- Weekly working hours can not exceed 48 hours

- Overtime may range from 10-11 hours on a daily basis (1 to 3 hours)

- No continuous (break-free) work for more than 5 hours in one go

- Weekly limit of 50-60 hours

- Quarterly limit of 50-150 hours

- Spreadover limit of 10-14 hours

Depending upon the rate fixed by states or union territories, employees are paid for the overtime hours apart from fixed working hours in the shops or establishments. In some of the states, the overtime amount is twice the usual working hours. Here again, the employee overtime rate is calculated for basic + allowances (not including any bonus).

Minimum Wages Act of States/ UTs

- If work time exceeds the fixed hours, employees be entitled to overtime payment rules for such hours or part of hour[5]

- Appropriate government may fix the overtime rate

- Employees be entitled to wages on overtime rate for working on a rest day

Mines Act, 1952

- Daily Working Hours - 9 hours a day above ground/ 8 hours a day under the ground

- Weekly hours - Maximum 48 hours a week

- Overtime - If a person works for more than fixed time (above or below the ground), he/ she is entitled to overtime wages twice the ordinary rate[6]

- The payment will be equivalent in case of employee works on a piece rate

- There is work hour limit of maximum 10 hours a day inclusive of overtime[7]

Contract Labour (Regulation & Abolition) Act, 1970

- A contractor has to maintain an Overtime Register maintaining the overtime hours and overtime wages paid to the workmen.[8]

Building and Other Construction Workers (Regulation of Employment Service) Act, 1996

- Work on a rest day be paid equivalent to overtime wages[9]

- Any worker working for more than fixed working hours on a day be entitled to overtime wages double the amount paid on usual working hours[10].

Working Journalist (Conditions of Service) and Miscellaneous Provisions Act, 1955

- Daily working hours - Maximum 6 hours in day shift and 5.5 hours in night shift

- Overtime - Working journalists working more than fixed hours are compensated with rest hours equivalent to the overtime hours.[11]

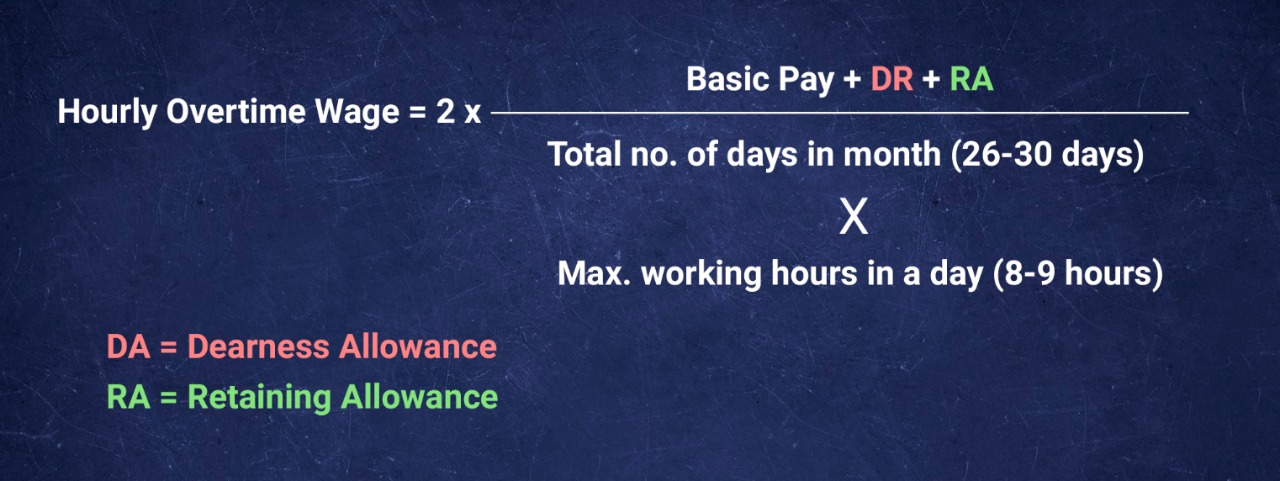

What is the formula for calculating overtime?

It is evident from the laws governing overtime payment rules mentioned above that the field of work and location (State or Union territory) plays an important role for which the overtime amount may vary. For instance, the overtime payment rules in Maharashtra may not be similar to that of Himachal Pradesh. However, on an average and for those industries governed by the central laws, the following overtime calculation formula in India may apply:

Is overtime calculated on basic or gross salary?

As per the overtime payment rules in India, it is calculated on basic salary. It may also include dearness or any other allowance. But it may be noted that labour law on overtime in India excludes any bonus or other such incentive while deciding or calculating overtime payment rules. In any case, the overtime payment rules do not regard the gross salary. But if there is no statutory obligation and the employer wishes to reward the hard-working employees voluntarily, overtime payment rules in India do not restrict the same. In such a case, whether overtime is paid on basic or gross in India is the employer’s choice.

Who is Eligible for Overtime Pay?

- A person working in any factory

- A person working in mines (underground or above ground)

- Working journalists

- Building or construction workers

- Any person working in a scheduled employment

- Any person working in a shop or establishment

- Contractual labour

Who is not Eligible for Overtime Pay in India?

- Any member of the armed forces

- Any person working beyond the overtime work limits

- Any person working overtime without authority

Although some states may not promote the overtime laws for salaried employees, the proposed labour codes do have overtime payment rules for white-collared salaried employees in India.

Can my employer make me work overtime without pay?

It depends upon the industry a person is employed in. If the employment falls under any one of those mentioned above, the employer can not make an employee work overtime without paying the overtime wages. However, for those working in an employment which is not governed by overtime laws for salaried employees, they may have to wait for the upcoming and updated labour codes in India.

[1] Section 51 of Factories Act, 1948.

[2] Section 54 of Factories Act, 1948.

[3] Section 55 of Factories Act, 1948.

[4] Section 56 of Factories Act, 1948.

[5] Section 14 of the Minimum Wages Act, 1948.

[6] Section 33 of the Mines Act, 1952.

[7] Section 35 of the Mines Act, 1952.

[8] Section 78 of the Contract Labour (Regulation & Abolition) Act, 1970.

[9] Section 28 (1)(c) of the Building and Other Construction Workers (Regulation of Employment Service) Act, 1996.

[10] Section 29 of the Building and Other Construction Workers (Regulation of Employment Service) Act, 1996.

[11] Section 10 of Working Journalist (Conditions of Service) and Miscellaneous Provisions Act, 1955.